What Is Indirect Tax ?

Indirect tax is a type of tax that is imposed on goods or services. Indirect tax is included in the purchase price of the products. Value added tax (VAT), sales tax, stamp duty, excise duties etc. are some examples of indirect taxes. In this post we are going to discuss some major advantages and disadvantages of indirect taxes.

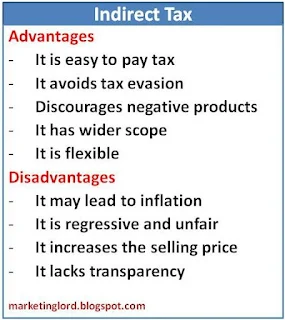

Advantages Of Indirect Tax

The main advantages of indirect tax are as follows:

1. Easy To Pay

Since indirect tax is included in the MRP (maximum retail price), people pay tax while purchasing the products or services. So, it is very easy to pay indirect taxes.

2. No Evasion

Indirect Tax is difficult to evade because it is added with the selling price. So, buyers cannot avoid or evade tax.

3. Wider Scope

Its scope is wider than the scope of direct tax because it is included in the price of the products and imposed on all individuals.

4. More Revenue

Because of wider coverage indirect tax generates more tax revenue for the government. So, it is one of the main source of country's revenue and helps in the economic development.

5. Discourage Negative Consumption

Government may impose higher tax for harmful products such as alcohol, tobacco etc. that helps to reduce the consumption of such products.

6. Flexible Nature

Tax rate can be adjusted (increase or decrease) as per the condition of the economy. So, it is flexible in nature.

7. Encourages Savings

Indirect tax encourages people to save and make investments because it does not reduce disposable income or profit.

Disadvantages Of Indirect Tax

The main disadvantages of indirect tax can be pointed out as follows:

1. Inflationary

When taxes are imposed on the products or services then the price will increase that may lead to inflation. It reduces the purchasing power of the people.

2. Regressive And Unfair

As we know that indirect tax is included in the price of the commodities, both rich and poor customers have to pay same amount of tax while purchasing the products. So, poor people may feel penalized by tax.

3. Increased Price

Another disadvantage of indirect tax is that it increases the price of the products. It increases the price of raw materials that leads to increase the cost of production. Increased cost of production leads to increase in the selling price of the products.

4. Discourage Open Trade

Indirect tax may restrict free trade because of high import and export duties. So, it discourages open trade.

Also Read

Advantages and disadvantages of direct tax

5. Lack Of Transparency

Individuals cannot determined the exact amount of tax they paid. Tax authorities also cannot determine the actual amount of tax collected for the people. So, it lacks transparency and certainty.

Pros And Cons Of Indirect Tax In Brief

Pros

* It is simple and easy to pay and collect

* It has wider scope than direct tax

* It improves the balance of payment

* It generates huge government revenue

* It is economical as well as flexible

Cons

* It lacks transparency and certainty

* It increases the selling price that may lead to inflation

* It may restrict open trade

* It is regressive and unfair

* It can burden poor individuals