Introduction

Capital structure refers to the mixture of equity and debt capital employed by a company to finance its operations. Equity capital includes common shares, preference shares, owner's money, retained earnings etc. and debt equity includes long-term and short term loans or debts. Proper mixing of debt and equity is known as optimal capital structure that helps to minimize the risk and maximize the profitability of the company.

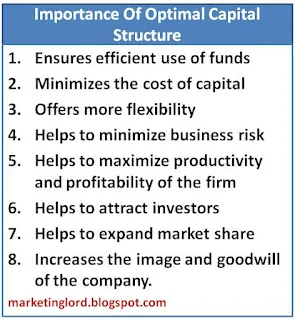

Importance Of Optimal Capital Structure

The main importance or significance of ideal capital structure can be highlighted as follows:

1. Efficient Use Of Funds

Optimal capital structure helps the firm to use available funds in effective and efficient way. It minimizes the risk of over or under capitalization.

2. Minimize The Cost Of Capital

Another importance of sound capital structure is that it reduces the cost of capital. Firms can keep the cost of capital to the lowest point with well structured capital setup.

3. Offers Flexibility

Ideal capital structure helps the firms to adjust according to the surroundings. It provides flexibility so that firms can easily cope with the changing business environment.

4. Risk Minimization

As we know that good capital structure ensures proper utilization of funds, it helps to increase efficiency and performance of business activities. It helps to maintain proper cash flow that helps to minimize the financial risk.

5. Profit Maximization

Because of optimum utilization of financial resources and minimization of business risks, it helps to increase the productivity and profitability. Therefore, it provides higher return to investors.

6. Attract More Investors

Proper capital structure helps to maintain sound financial health of the company. Because of less risk, high return and good financial position, market value of the company will be increased. In this situation, more investors are attracted to invest in a stock of the company.

Also Read

Features Of Ideal Capital Structure

7. Growth And Expansion

Sound capital structure helps the company to expand the market share.

8. Increase Goodwill And Image

Properly formed capital structure increases the creditworthiness and reputation of the firm. So, it helps to improve the goodwill and image of the company.