Introduction And Meaning Of Cost Accounting

In simple words, cost accounting is the process of identifying, summarizing and analyzing the cost of process, products, jobs, services etc. It is a method of determining the cost of production by tracking all costs (such as variable costs, fixed costs, direct costs, indirect costs etc.) associated with the production or manufacturing process. It provides correct and up-to-date cost data and information which helps the management for decision making, forecasting and future planning.

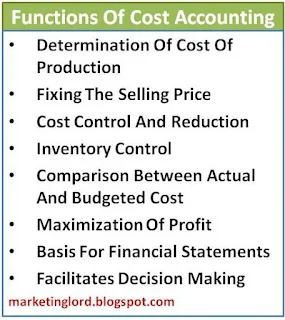

Functions Of Cost Accounting

The main functions of cost accounting can be pointed out as follows:

1. Determination Of Cost Of Production

Cost accounting identifies and captures all costs (both variable and fixed costs) spent on production process, jobs, departments or services. It helps to determine the accurate cost of production of the company's products or services.

2. Determination Of Selling Price

As we know that cost accounting ascertains the cost of production per unit of products, it helps the company to determine selling price of its products. Management can set proper selling price by adding profit margin in the production cost.

3. Cost Control And Reduction

It examines all business costs such as material costs, labor costs and other expenses and prepares cost data. Cost data and information helps the management to control or reduce unnecessary costs in the production process.

Cost accounting properly observes the inventory and prevents over ordering or under ordering of raw materials. So, it facilitates inventory control.

5. Cost Comparison

Another function of cost accounting is that it compares actual costs with budgeted cost by using different costing methods. It identifies the cause of difference between standard and actual costs which helps the management to take corrective measures.

6. Profit Maximization

Cost accounting helps to control unnecessary costs, wastage and mishandling of raw materials. It leads to decrease in the cost of production which maximizes the profit of the firm.

Also Read:

Functions Of Financial Accounting

Functions Of Management Accounting

7. Facilitates Decision Making

It prepares cost data and provides information to the top level management of the company. It helps the management to make financial decisions and formulate future plans and policies.

8. Basis For Financial Statements

Financial statements of the company are prepared on the basis of data provided by cost accounting. It provides data and information regarding production, sales and other financial activities of the business.