Introduction

Trading account refers is a financial document prepared by the business firms to understand the gross profit or loss from trading activities for a specific period of time. Cost of goods sold is subtracted from net sales to determine gross profit of the firm. Trading account is an integral part of final accounts that helps to determine the profitability and analyze the efficiency of the business.

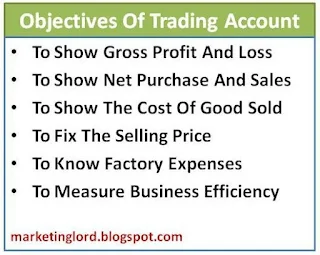

Purposes Or Objectives Of Trading Account

The main objectives of preparing trading account can be described as follows:

1. To Show Gross Profit And Loss

Trading account determines gross profit and gross loss of the business at the end of the period.

2. To Show Net Purchase And Sales

Trading account determines the amount of net purchase and sales during the accounting period.

3. To Show Cost Of Good Sold

It calculates the cost of good sold at the end of the period. It can be calculated by using the following formula:

Cost Of Goods Sold = Opening Stock + Purchase - Closing Stock

4. Fixation Of Price

Trading account helps to fix selling price of the product by showing the relationship between sales and cost of goods sold.

5. To Know Expenses

Also Read:

6. To Show Stock Position

Trading account gives detail information about stock position.

7. Efficiency Of Business

It helps to measure business efficiency by comparing sales and expenses.

8. To Help Preparing Profit And Loss Account

Balance of trading account (gross profit or loss) is used to prepare profit and loss account. So, it serves as a basis for profit and loss account.

9. To Facilitate Decision Making

It helps the management to make decisions regarding production, pricing, controlling etc.