What Is Depreciation ?

Depreciation refers to the reduction in the book value of fixed assets over a time period due to different reasons such as regular use, obsolescence etc. In accounting, depreciation is a method of allocating the cost of an asset over its useful life.

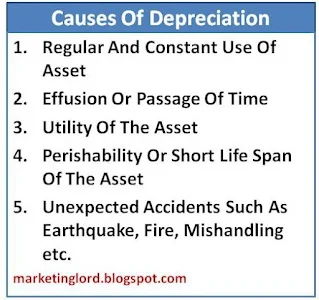

Causes Of Depreciation

The main causes of depreciation of assets can be expressed as follows:

1. Regular Use

Regular and constant use may reduce the efficiency of the asset. So, depreciation arises due to wear and tear of an asset.

2. Passage Of Time

Usefulness of the asset will decline with the passage of time. So, effusion of time is another major factor of depreciation. It is considered as natural depreciation.

3. Obsolescence (Because Of Technological Advancement)

Utility of the asset may reduce because of change in fashion, new technology and new invention. So, asset will become out of date and depreciation arises.

Also Read:

Also Read:

4. Perishability

Perishability is another factor that causes depreciation. Assets like inventory and raw materials have short life span than fixed assets.

5. Accidents

Value of assets may be depreciated due to unexpected accidents like fire, earthquake, mishandling etc.

6. Poor Upkeep

Poor upkeep is another factor that leads to depreciation. Inadequate maintenance decreases the lifespan of tangible assets.

7. Legal Requirements And Regulations

Depreciation is affected by the change in government regulations and legal requirements such as emission standards, safety standards etc. may influence the rate of depreciation.

8. Economic Factors

Economic factors such as inflation, economic downturn and reduction in demand also impact the rate of depreciation.

9. Environmental Factors

Environmental factors such as moisture, weather, temperature fluctuation etc, accelerate the rate of depreciation of tangible assets such as equipment, machinery, buildings etc.