Introduction

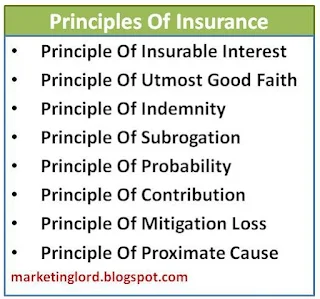

An insurance is an agreement between the insurer and insured. For the validity of agreement (contract) , certain basic elements should be considered. These elements of the agreement of insurance are called principles of insurance.

The following fundamental principles are involved in insurance business.

1. Principle of insurable interest

Insurable interest is a basic element of insurance. The policyholder as a party to the insurance contract must have a particular relationship with the subject matter of the insurance, whether it is the life or property or a liability to which he is exposed.

There are at least four features essential to insurable interest:

* There must be some property, right, life or potential liability capable of being insured.

* Such property, right, interest etc. must be the subject matter of insurance.

* The insured must have relationship with the subject-matter of insurance whereby he benefits from its safety, or freedom from liability and would be prejudiced by its damaged or the existence of liability.

* The relationship between the insured and the subject-matter of insurance must be recognized at law.

2. Principle of utmost good faith

Although the proposer can examine a specimen of the policy before accepting its terms, the insurer is at a disadvantage because he cannot examine all aspects of the proposed insurance that are material to him. Only the proposer knows all the relevant facts about the risk being proposed. The underwriter can have a survey carried out but he must rely on information given by the insured in order to assess those aspects of the risks that are not apparent at the time of a survey. The insured should disclose clearly about the terms and conditions and should give the true information of a risk.

3. Principle of indemnity

Indemnity may be defined as financial compensation. According to this principle, the insurer makes compensation to the insured against the loss in financial terms. This principle clarifies that the insurance is only for compensation of loss but not for any financial benefit. Compensation given to the insured can never be more than the actual loss.

Also Read:

4. Principle of subrogation

If the insured is indemnified by the insurer, the insurer acquires a right to recover any possible benefit due to insured from the third party. It is known as the principle of subrogation. It means by paying the amount of loss to the insured, the insurer gets right to recover any wastage properties available with insured.

5. Principle of probability

According to the principle of probability, everything remaining the same, the future risk or financial liability and other expenses are calculated on the assumption that future will be like in the past. This principle pays attention to the experience of previous years by considering some changes to calculate the expenses. Thus, this principle takes into account of the situation of previous years- risks, expenses, number of deaths, paid claims etc. to forecast the probability of similar risks and expenses being encountered in the future which is known as principle of probability.

6. Principle of contribution

The principle of contribution is a part of indemnity. A person can get insurance policies from more than one insurance company for a single property. The intention of insuring with more than one insurance company is to ear profit. This principle has restricted. to do so because the insured can get only the actual loss from an insurance company or from all insurance companies on the proportion of the premium paid. This prevents the insured to make profit from insurance by making artificial losses.

7. Principle of mitigation loss

Another essential principle of insurance is mitigation of loss. This principle assumes that is the responsibility of the insured to take necessary steps to reduce the loss of the subject matter.

8. Principle of proximate cause

It is important to state the perils against which the insurance coverage is given so that the intention of the parties is clearly defined. Under this principle, the insurer covers only the insured cause. For example, if a person purchase an insurance policy of his building against fire. The building is damaged due to the earthquake. In this case, compensation is not payable.